We all know the about the glitches of GST Site during regular filing of GSTR-1 and GSTR-3B. Delay in receiving OTPs, login issue, signing failure and many more and the reason is, limitation of GST site to handle traffic on portal. On 22nd January 2020, Finance ministry tried to solve it temporarily and issued a press release that tax payers can file GSTR-3B in staggered manner, So now we have 3 dates for filing GSTR-3B.

– Taxpayers having Annual Turnover more than 5 Crores – 20th of Following month

– Taxpayers having Annual Turnover less than 5 Crores – 22nd & 24th of following depending upon which state or UT they are registered in. You can access press release here https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1600249

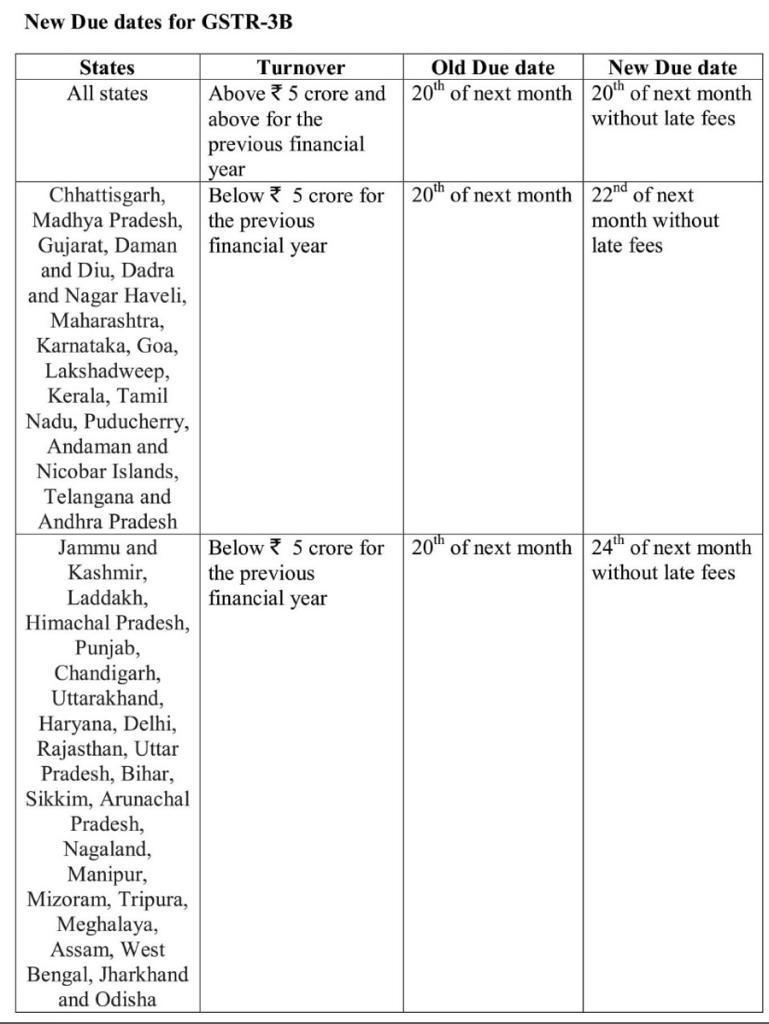

To summarize the press release here is table to explain to who can file GSTR-3B on 22nd and who can file on 24th