Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

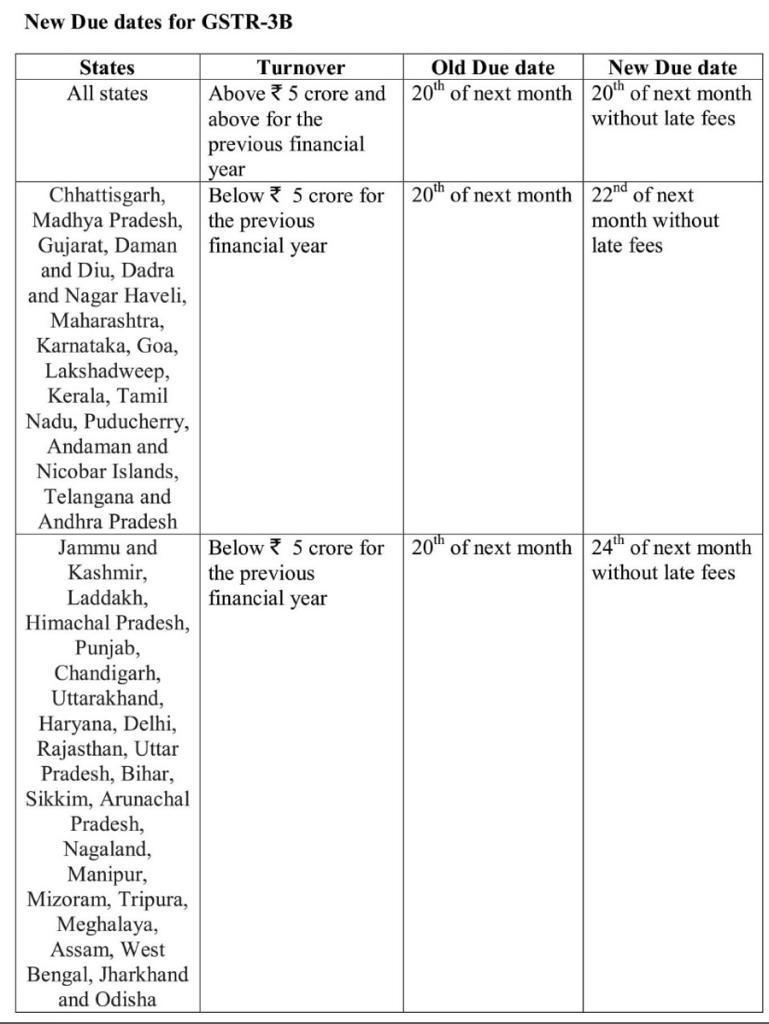

We all know the about the glitches of GST Site during regular filing of GSTR-1 and GSTR-3B. Delay in receiving OTPs, login issue, signing failure and many more and the reason is, limitation of GST site to handle traffic on portal. On 22nd January 2020, Finance ministry tried to solve it temporarily and issued a press release that tax payers can file GSTR-3B in staggered manner, So now we have 3 dates for filing GSTR-3B.

– Taxpayers having Annual Turnover more than 5 Crores – 20th of Following month

– Taxpayers having Annual Turnover less than 5 Crores – 22nd & 24th of following depending upon which state or UT they are registered in. You can access press release here https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1600249

To summarize the press release here is table to explain to who can file GSTR-3B on 22nd and who can file on 24th

We all know Credit and debit notes and why it need to be issued in GST, but we are discussing a specific issue here i.e. issue of credit/debit note when all the particulars of Invoice are correct except for rate of tax charged.

For Eg: Taxable Value – Rs. 1000+18% GST i.e Rs. 1180/- instead of Rs. 1000+12% GST i.e. Rs. 1120/- now we only have to change the tax value (from Rs.180/- to Rs. 120/-) because taxable value need no correction. This issue is specific beacasue till now GSTR-1 doesn’t allow feeding nil taxable value, so untill unless we feed some taxable it wouldn’t allow to move further to correct the difference of Tax charged.

Simple solution in this case would be to enter taxable value as Rs. 1/- and modify the full Tax value. Later on during filing Annual return and Audit your CA can verify and certify the same.

This Particular issue is being taken up in upcoming GST Return ANX-1

This is an example post, originally published as part of Blogging University. Enroll in one of our ten programs, and start your blog right.

You’re going to publish a post today. Don’t worry about how your blog looks. Don’t worry if you haven’t given it a name yet, or you’re feeling overwhelmed. Just click the “New Post” button, and tell us why you’re here.

Why do this?

The post can be short or long, a personal intro to your life or a bloggy mission statement, a manifesto for the future or a simple outline of your the types of things you hope to publish.

To help you get started, here are a few questions:

You’re not locked into any of this; one of the wonderful things about blogs is how they constantly evolve as we learn, grow, and interact with one another — but it’s good to know where and why you started, and articulating your goals may just give you a few other post ideas.

Can’t think how to get started? Just write the first thing that pops into your head. Anne Lamott, author of a book on writing we love, says that you need to give yourself permission to write a “crappy first draft”. Anne makes a great point — just start writing, and worry about editing it later.

When you’re ready to publish, give your post three to five tags that describe your blog’s focus — writing, photography, fiction, parenting, food, cars, movies, sports, whatever. These tags will help others who care about your topics find you in the Reader. Make sure one of the tags is “zerotohero,” so other new bloggers can find you, too.